Following the density of the literature and the consensus in empirical studies, the aim of this article is to examine the nature of the relationship between foreign direct investment (FDI) and carbon dioxide (CO2) emissions in sub-Saharan Africa (SSA). To this end, the methodological strategy employed is based not only on a theoretically sound multivariate framework, but also on recent developments in panel data econometrics, namely fully modified ordinary least squares (FMOLS) estimators, dynamic ordinary least squares (DOLS) estimators and the vector error correction model. In addition, the stationarity properties of the panel variables are examined, and the panel cointegration technique is used to test cointegrating relationships in the series of variables. The panel is composed of 38 SSA countries over the period 2000-2022. The main results show that in SSA: the variables move together in the long term. A 1% increase in inward FDI increases CO2 emissions by 0.210%. This result suggests that FDI has flowed to SSA because of its weak environmental regulations, thus verifying the pollution haven hypothesis. In the long term, there is a bidirectional relationship between inward FDI and CO2 emissions. In all the models used, renewable energy consumption reduces CO2 emissions. Therefore, SSA needs to put in place effective environmental rules to better guide FDI; put in place strategies to harness and add value to its energy sector, implement policies and strategies that ensure FDI attractiveness without abandoning the environment.

| Published in | International Journal of Economy, Energy and Environment (Volume 9, Issue 5) |

| DOI | 10.11648/j.ijeee.20240905.11 |

| Page(s) | 105-118 |

| Creative Commons |

This is an Open Access article, distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution and reproduction in any medium or format, provided the original work is properly cited. |

| Copyright |

Copyright © The Author(s), 2024. Published by Science Publishing Group |

Foreign Direct Investment, CO2 Emissions, FMOLS, DOLS, Sub-Saharan Africa

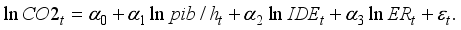

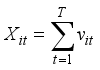

(1)

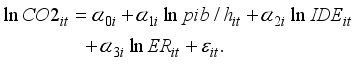

(1)  (2)

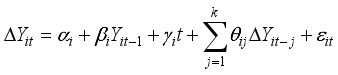

(2)  .(3)

.(3)  is the first difference operator, is the dependent variable, is a white noise disturbance with variance of, and t = 1,..., T.

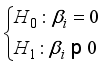

is the first difference operator, is the dependent variable, is a white noise disturbance with variance of, and t = 1,..., T.  Which alternative hypothesis corresponds to stationary.

Which alternative hypothesis corresponds to stationary.  (where

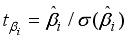

(where  is the OLS estimator of

is the OLS estimator of  in equation (3) and

in equation (3) and  is its standard error.

is its standard error.  by keeping it identical across countries as follows:

by keeping it identical across countries as follows:  .(4)

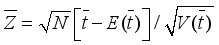

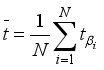

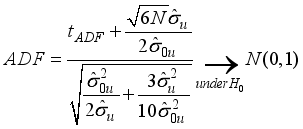

.(4)  With the statistic-based test

With the statistic-based test

:

:  .(5)

.(5)  ,

,  and

and  are respectively the mean and variance of each statistic, and they are generated by simulations. Unlike the IPS test, which is parametric and asymptotic,

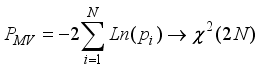

are respectively the mean and variance of each statistic, and they are generated by simulations. Unlike the IPS test, which is parametric and asymptotic,  .(6)

.(6)  (7)

(7)

;

;  ,

,  is the cumulative sum of residuals and

is the cumulative sum of residuals and  is the estimator of

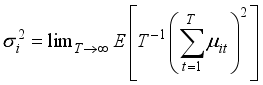

is the estimator of  . Hadri (2000) proposes two cases:

. Hadri (2000) proposes two cases:  and

and  , if the model includes only the constant;

, if the model includes only the constant;  et

et  , if the model includes the constant and the trend.

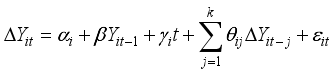

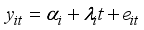

, if the model includes the constant and the trend.  (8)

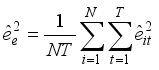

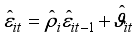

(8)  is the individual specific effect,

is the individual specific effect,  is the deterministic trend and

is the deterministic trend and  is the estimated residual, which represents deviations from the long-term relationship. The structure of the estimated residuals is as follows:

is the estimated residual, which represents deviations from the long-term relationship. The structure of the estimated residuals is as follows:  .(9)

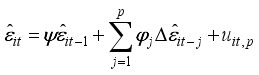

.(9)

, where

, where  denotes the autoregressive term of the residuals estimated under the alternative hypothesis. In our analysis, in addition to applying

denotes the autoregressive term of the residuals estimated under the alternative hypothesis. In our analysis, in addition to applying  .(10)

.(10)  ,

,  ;

;  et i = 1, 2, …, N.

et i = 1, 2, …, N.  .(11)

.(11)  is selected when the

is selected when the  are uncorrelated under the assumption of no cointegration.

are uncorrelated under the assumption of no cointegration.

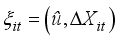

is the t-statistic of

is the t-statistic of  , and

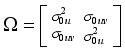

, and  comes from the covariance matrix

comes from the covariance matrix  of the bivariate process

of the bivariate process  .

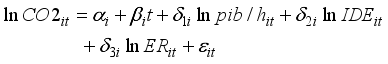

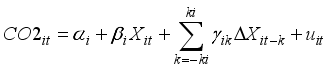

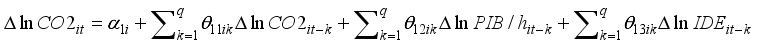

.  : i = 1,2,…,N;t = 1,2,…,T(12)

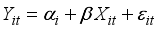

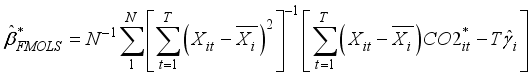

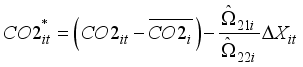

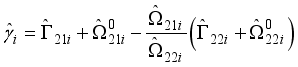

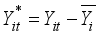

: i = 1,2,…,N;t = 1,2,…,T(12)  is the logarithm of CO2 emissions in metric tons per capita and

is the logarithm of CO2 emissions in metric tons per capita and  is the logarithm of the independent variable and

is the logarithm of the independent variable and  and

and  are cointegrated with the coefficient

are cointegrated with the coefficient  , which may or may not be homogeneous across i. Note that the characteristic equation of the FMOLS and DOLS estimators is an extension of standard regression, in which lags and leads are incorporated into the cointegrating relationship in order to asymptotically reproduce unbiased estimators and avoid the problems associated with estimating nuisance parameters. According to equation (12),

, which may or may not be homogeneous across i. Note that the characteristic equation of the FMOLS and DOLS estimators is an extension of standard regression, in which lags and leads are incorporated into the cointegrating relationship in order to asymptotically reproduce unbiased estimators and avoid the problems associated with estimating nuisance parameters. According to equation (12),  is a stationary vector made up of the estimated residuals from the cointegration regression and differences in FDI attractiveness.

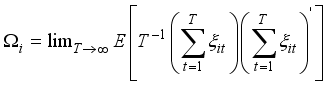

is a stationary vector made up of the estimated residuals from the cointegration regression and differences in FDI attractiveness.  is the long-term covariance for this vector process, which can be decomposed as follows:

is the long-term covariance for this vector process, which can be decomposed as follows:  where

where  denotes the contemporaneous covariance and

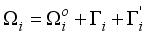

denotes the contemporaneous covariance and  is a weighted sum of autocovariances. FMOLS estimators are given by:

is a weighted sum of autocovariances. FMOLS estimators are given by:  .(13)

.(13)  and

and  .

.  where

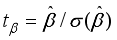

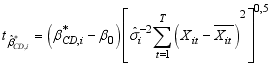

where  is the FMOLS estimator applied to the ith panel member. The t-statistics are calculated as follows:

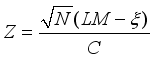

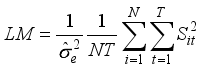

is the FMOLS estimator applied to the ith panel member. The t-statistics are calculated as follows:

.

.  is the test statistic calculated for the ith panel member. Its asymptotic distribution is the normal distribution centered reduced.

is the test statistic calculated for the ith panel member. Its asymptotic distribution is the normal distribution centered reduced.  (14)

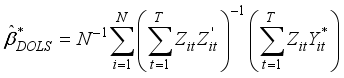

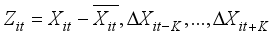

(14)  is a vector of 2(K+1)1.

is a vector of 2(K+1)1.  and

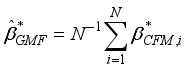

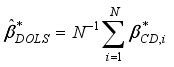

and  . The DOLS inter-dimensional estimator can be constructed as follows

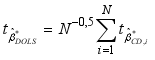

. The DOLS inter-dimensional estimator can be constructed as follows  where

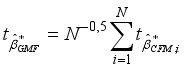

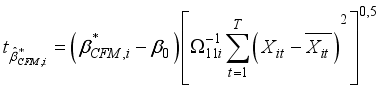

where  the DOLS estimator applied to the ith panel member is. The t-statistics are:

the DOLS estimator applied to the ith panel member is. The t-statistics are:  where

where  is the long-term variance of the residuals from the DOLS regression is

is the long-term variance of the residuals from the DOLS regression is  .

.

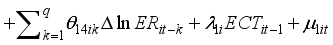

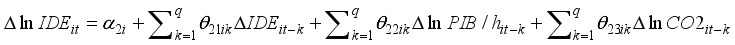

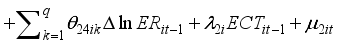

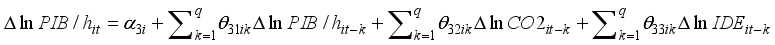

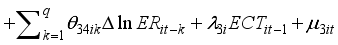

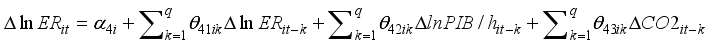

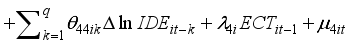

;(15)

;(15)

;(16)

;(16)

;(17)

;(17)

(18)

(18)  is the one-period lagged error correction term derived from the long-term cointegration relationship. According to

is the one-period lagged error correction term derived from the long-term cointegration relationship. According to  gives the integer part of the number of years of absorption.

gives the integer part of the number of years of absorption.

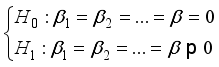

and

and  HA:

HA:

and

and  and HA:

and HA:

and

and

Variables | LLC | Breitung | IPS | ADF | PP | Hadri | Hadric | |

|---|---|---|---|---|---|---|---|---|

In level | lnCO2 | 0,652 (0,521) | 1,251 (0,854) | 2,558* (0,000) | 3,594 (0,100) | 4,002 (0,336) | 4,256 (0,554) | 2,245* (0,000) |

LnPIB | 0,022 (0,254) | 3,701 (0,548) | 7,878 (0,772) | -1,282 (0,811) | 2,884 (0,996) | 4,018 (0,621) | 5,021 (0,362) | |

lnIDE | 2,112 (0,114) | 1,111 (0,963) | -0,214 (0,963) | 9,245 (0,845) | 1,891 (0,145) | 5,256* (0,000) | 4,114* (0,000) | |

LnER | 0,215 (0,451) | 1,895 (0,571) | 0,287 (0,741) | 4,253 (0,205) | 7,241* (0,000) | 8,562* (0,000) | 3,587* (0,000) | |

In first difference | ∆lnCO2 | -4,01* (0,000) | -0,559* (0,000) | -1,11* (0,007) | 44,33* (0,007) | 81,01* (0,007) | 5,012* (0,000) | 1,230* (0,000) |

∆lnPIB | 1,14* (0,001) | 0,021* (0,000) | -2,77* (0,000) | 49,51* (0,001) | 52,12* (0,000) | -1,210* (0,000) | 1,237* (0,000) | |

∆lnIDE | -0,25* (0,000) | 7,21* (0,000) | 1,457* (0,000) | 10,87* (0,001) | 7,96* (0,001) | -1,111 (0,201) | 0,827* (0,001) | |

∆lnER | -4,28* (0,000) | -5,777* (0,001) | -3,58* (0,003) | 65,62* (0,000) | 63,22* (0,000) | 4,555* (0,000) | 0,989* (0,008) | |

Methods | Intra Dimension (panel statistics) | Inter Dimension (individual statistics) | ||||

|---|---|---|---|---|---|---|

Tests | Stat | Prob | Tests | Stat | Prob | |

[39] | V Panel statistics | 0,589* | 0,000 | Group statistics ρ | 1,735 | 0,987 |

ρ Panel statistics | -0,253 | 0,001 | Group statistics pp | -1,589 | 0,893 | |

PP Panel statistics | -1,411 | 0,002 | Group statistics | -1,719 | 0,417 | |

V Panel statistics ADF | -0,986 | 0,003 | ADF | |||

[40] | V Panel statistics | 1,047 | 0,413 | |||

ρ Panel statistics | -0,868 | 0,087 | ||||

PP Panel statistics v | -0,967 | 0,059 | ||||

Panel statistics ADF | -0,270 | 0,234 | ||||

Model | ADF | P-value |

|---|---|---|

lnCO2, lnIDE, lnPIB, lnER | -1,205 | 0,031** |

Null hypothesis | Alternative hypothesis | Trace Test | Eigenvalue test |

|---|---|---|---|

r = 0 | r > 1 | 41,01* (0,001) | 25,25* (0,001) |

r ≤ 1 | r > 2 | 8,12 (0,524) | 11,21 (0,241) |

r ≤ 2 | r > 3 | 14,13 (0,784) | 9,37 (0,793) |

Dependent variable lnCO2 | FMOLS | DOLS | ||||||

|---|---|---|---|---|---|---|---|---|

Independent variables | Independent variables | |||||||

lnIDE | lnIDE, lnPIB | lnIDE, lnER | lnIDE, lnPIB, lnER | LnIDE | lnIDE, lnPIB | lnIDE, lnER | lnIDE, lnPIB, lnER | |

Inter results | ||||||||

C | 0,210** (0,031) | 0,725** (0,038) | 0,001* (0,002) | 0,035*** (0,072) | 0,238** (0,042) | 1,415** (0,024) | 0,002* (0,001) | 0,058*** (0,071) |

With TD | 0,471** (0,04) | 0,998*** (0,08) | 0,999** (0,04) | 0,251* (0,007) | 0,325*** (0,077) | 1,830 (0,214) | 0,101** (0,023) | 0,011* (0,001) |

Intra results | ||||||||

C | 0,111** (0,041) | 0,994** (0,049) | 0,005* (0,001) | 0,071*** (0,06) | 0,283** (0,044) | 0,871** (0,038) | 0,004* (0,004) | 0,041*** (0,07) |

With TD | 0,144*** (0,07) | 0.771* (0,001) | 0,006*** (0,08) | 0,035 (0,874) | 0,477*** (0,07) | 0,610 (1,444) | 0,007** (0,031) | 0,071 (0,755) |

Dependent variables | Sense of causality | ||||||

|---|---|---|---|---|---|---|---|

∆lnCO2t | ∆lnPIBt | ∆lnIDEt | ∆lnERt | ||||

Source of Causality (Independent variables) | CT | ∆lnCO2t | - | -0,08** (0,032) | 0,024 (0,981) | -0,041 (0,781) | CO2→PIB |

∆lnPIBt | 0,017* (0,001) | - | 0,001** (0,032) | 0,017 (0,741) | PIB→CO2, IDE | ||

∆lnIDEt | 0,214* (0,002) | 0,141* (0,001) | - | 0,003* (0,002) | IDE→CO2, PIB, ER | ||

∆lnERt | -0,008* (0,001) | 0,049* (0,005) | 0,013 (0,897) | - | ER→CO2, PIB | ||

Test CJ (CT et LT) | ∆lnCO2t-1, ECTt-1 | - | 4,014* (0,001) | 2,014* (0,004) | 3,893** (0,041) | CO2→PIB, IDE et ER | |

∆lnPIBt-1, ECTt-1 | 4,251* (0,004) | - | 2,111* (0,001) | 5,625*** (0,052) | PIB→CO2, IDE et ER | ||

∆lnIDEt-1, ECTt-1 | 3,333* (0,007) | 2,111* (0,002) | - | 2,241** (0,024) | IDE→CO2, PIB et ER | ||

∆lnERt-1, ECTt-1 | 2,582* (0,002) | 4,257** (0,032) | 2,258*** (0,08) | - | ER→CO2, PIB et IDE | ||

Dependent variables | |||||

|---|---|---|---|---|---|

∆lnCO2t | ∆lnPIBt | ∆lnIDEt | ∆lnERt | ||

Source of causality (independent variables) | ∆lnCO2t -1 | -0,041 (0,414) | 0,451 (0,541) | 0,631 (0,451) | 0,251 (0,123) |

∆lnPIBt – 1 | 0,101*** (0,07) | -0,521 (0,691) | 0,004** (0,03) | 0,023* (0,003) | |

∆lnIDEt -1 | 0,204** (0,04) | 0,127** (0,03) | -0,125 (0,631) | 0,0023 (0,862) | |

∆lnERt -1 | -0,147* (0,001) | 0,025 (0,571) | 0,011 (0,177) | -0,638 (0,477) | |

ECTt-1 | -0,318* (0,001) | -0,396* (0,004) | -0,175* (0,001) | -0,155* (0,003) | |

C | 1,0021** (0,042) | 1,314** (0,036) | 0,993** (0,041) | 0,931** (0,032) | |

ADF | Augmented Dickey-Fuller |

CO2 | Carbon Dioxide Emission |

DOLS | Dynamic Ordinary Least Squares |

ECT | Error Correction Term |

EKC | Environmental Kuznets Curve |

FDI | Foreign Direct Investment |

FMOLS | Fully Modified Ordinary Least Squares |

GDP | Gross Domestic Product |

WDI | World Development Indicator |

SSA | Sub-saharan Africa |

| [1] | Abdouli. M. and Omri A. “Exploring the Nexus Among FDI Inflows, Environmental Quality, Human Capital, and Economic Growth in the Mediterranean Region.” J Knowl Econ 12, 788-810 (2021). |

| [2] | Acheampong A. O., Samuel A. and Elliot B. «Do globalization and renewable energy contribute to carbon emissions mitigation in Sub-Saharan Africa? », Science of the Total Environment, 2019. |

| [3] | Andriamahery A., Danarson J. and Qamruzzaman Md. «Nexus between trade and environmental quality in sub-saharan Africa: Evidence from panel GMM», Frontiers in Environmental Science, 10. 10.3389/fenvs.2022.986429, 2022. |

| [4] | Awad A. and Warsam M. «Climate changes in Africa: does economic growth matter? A semi-parametric approach», International Journal of Energy Economic and Policy, 7, 1-8, 2017. |

| [5] | Balsalobre-Lorente D., Gokmenoglu K. K., Taspinar N. et al. “An approach to the pollution haven and pollution halo hypotheses in MINT countries”. Environ Sci Pollut Res 26, 23010–23026 (2019). |

| [6] | Bildirici M. and Gokmenoglu S. M. «The impact of terrorism and FDI on environmental pollution: evidence from Afghanistan, Iraq, Nigeria, Pakistan, Philippines, Syria, Somalia, Thailand and Yemen», Environmental Impact Assessment Review, 81, 106340, 2020. |

| [7] | Bobbo A. «Volatilité de l’inflation, gouvernance et investissements directs étrangers entrants en Afrique sub-saharienne», African Development Review, 30, 86-99, 2018. |

| [8] | Chirambo D. «Towards the achievement of SDG 7 in sub-Saharan Africa: Creating synergies between Power Africa, Sustainable Energy for All and climate finance in-order to achieve universal energy access before 2030», Renewable and Sustainable Energy Reviews, 94, 600-608, 2018. |

| [9] | Choi I. «Unit Root Tests for Panel Data», Journal of International Money and Finance, 20, 249-272, 2001. |

| [10] | Cole M. A. and Neumayer E. “Examining the Impact of Demographic Factors on Air Pollution”. Population and Environment, 5–21 (2004). |

| [11] | CNUCED «Rapport sur le commerce et le développement 2019: Le financement d’une Nouvelle donne écologique mondiale», 2019. |

| [12] | Demena B. A. and Afesorgbor S. K. «The effect of FDI on environmental emissions: Evidence from a meta-analysis», Energy Policy, 138, 111192, 2020. |

| [13] | Emrah K. and Aykut Ş. «The impact of foreign direct investment on CO2 emissions in Turkey: new evidence from cointegration and bootstrap causality analysis», Environmental Science and Pollution Research International, 25, 790-804, 2018. |

| [14] | Engle R. F. and Granger C. W. J. «Cointegration and Error-Correction: Representation, Estimation and Testing», Econometrica, 64, 813-836, 1987. |

| [15] | Eriandani R., Anam., Prastiwi D. and Triani A. N. N. «The Impact of Foreign Direct Investment on CO2 Emissions in ASEAN Countries», International Journal of Energy Economics and Policy, 10, 584-592, 2020. |

| [16] | Eskeland G. S. and Harrison A. E. «Moving to greener pastures? Multinationals and The pollution haven hypothesis», Journal of Development Economics, 70, 1-23, 2003. |

| [17] | Essandoh O. K., Islam M. and Kakinaka M. «Linking international trade and foreign direct investment to CO2 emissions: Any differences between developed and developing countries?», Science of The Total Environment, 712, 136437, 2020. |

| [18] | Farooq F., Chaudhry S., Yusop Z. and Habibullah M. S. «How Do Globalization and Foreign Direct Investment Affect Environmental Quality in OIC Member Countries», Pakistan Journal of Commerce and Social Sciences, 14, 551-568, 2020. |

| [19] | Ganda F. «The influence of growth determinants on environmental quality in SubSaharan Africa states», Environment, Development and Sustainability. 23, 7117-7139, 2021. |

| [20] | Gharnit S., Bouzahzah M. and Ait Soussane J. «Impact of foreign direct investment on CO2 emissions in Morocco: An empirical investigation», Journal of Economic Benchmarks and Perspectives, 4, 213-226, 2020. |

| [21] | Grossman G. M. and Krueger A. B. «Environmental Impacts of North American Free Trade Agreement», Discussion Papers in Economics, No. 158, Woodrow Wilson School of Public and International Affairs, Princeton, NJ, 1991. |

| [22] | Hadri K. «Testing for Stationarity in Heterogeneous Panel Data», Econometric Journal, 3, 148-161, 2000. |

| [23] | Hille E., Shahbaz M. and Mose I. «The impact of FDI on regional air pollution in the Republic of Korea: a way ahead to achieve the green growth strategy?», Energy Economics, 81, 308-326, 2019. |

| [24] | Im KS., Pesaran MH. And Shin Y. «Testing for unit roots in heterogeneous panels», Journal of econometrics, 115, 53-74, 2003. |

| [25] | Johansen S. «Statistical analysis of cointegration vectors», Journal of economic dynamics and control, 12, 231-254, 1988. |

| [26] | Jugurnath B., Chuckun N. and Fauzel S. «Foreign Direct Investment & Economic Growth in Sub-Saharan Africa: An Empirical Study», Theoretical Economics Letters, 6, 798-807, 2016. |

| [27] | Kao C. «Spurious Regression and Residual-Based Tests for Cointegration in Panel Data», Journal of Economic, 90, 1-44, 1999. |

| [28] | Khan M. A. and Ozturk I. «Examining foreign direct investment and environmental pollution linkage in Asia», Environmental Science and Pollution Research, 27, 7244-7255, 2020. |

| [29] | Kivyiro P. and Arminen H. «Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: Causality analysis for Sub-Saharan Africa», Energy, 74, 595-606, 2014. |

| [30] | Kostakis I., Lolos S. and Sardianou E. «Foreign direct investment and environmental degradation: Further evidence from Brazil and Singapore», Journal of Environmental Management and Tourism, 8, 45-59, 2017. |

| [31] | Kriaa I., Ettbib R. and Akrout Z. «Foreign direct investment and industrialization of Africa», International Journal of Innovation and Applied Studies, 21, 477-491, 2017. |

| [32] | Kwiatkowski D., Phillips C. B., Schmidt P. and Shin Y. «Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? », Journal of Econometrics, 54, 159-178, 1992. |

| [33] | Levin A., Lin C-F. and Chu C-SJ. «Unit root tests in panel data: asymptotic and finitesample Properties», Journal of econometrics, 108, 1-24, 2002. |

| [34] | Maddala G. S. and Wu S. «A Comparative Study of Unit Roots with Panel Data and a New Simple Test», Oxford Bulletin of Economics and Statistics, 61, 631-651, 1999. |

| [35] | Maeso-Fernandez F., Osbat C. and Schnatz B. «Towards the estimation of equilibrium exchange rates for transition economics: Methodological issues and a panel cointegration perspective», Journal of Comparative Economics, 34, 499-517, 2006. |

| [36] | Mert M. and Caglar A. E. «Testing pollution haven and pollution halo hypotheses for Turkey: a new perspective», Environmental Science and Pollution Research, 27, 32933-32943, 2020. |

| [37] | Ngwenya B., Oosthuizen J., Cross M., Frimpong K. and Chaibva C. N. «A review of heat stress policies in the context of climate change and its impacts on outdoor workers: evidence from Zimbabwe», International Journal of social Ecology and Sustainable Development, 9, 1-11, 2018. |

| [38] | Ongo Nkoa B. E. and Song S. J. «Africa’s fragility: An explanation by foreign direct investment?», Developing Worlds, 193, 47-68, 2021. |

| [39] | Pedroni P. «Critical Values for Cointegration Tests in Heterogeneous Panels with Multiple Regressors», Oxford Bulletin of Economics and Statistics, 61, 653-670, 1999. |

| [40] | Pedroni P. «Panel Cointegration: Asymptotic and Finite Sample Properties of Pooled Time Series Tests with an Application to the PPP Hypothesis: New Results», Econometric Theory, 20, 597-625, 2004. |

| [41] | Rahman Z. U., Chongbo W. and Ahmad M. «An (A)symmetric Analysis of the Pollution haven Hypothesis in the Context of Pakistan: A Non-linear Approach», Carbon Management, 10, 227-239, 2019. |

| [42] | Sabir S., Qayyum U. and Majeed T. «FDI and environmental degradation: the role of political institutions in South Asian countries», Environmental Science and Pollution Reserach, 27, 32544-32553, 2020. |

| [43] | Shahbaz M., Nasir M. A. and Roubaud D. «Environmental degradation in France: The effects of FDI, financial development, and energy innovations», Energy Economics, 74, 843-857, 2018. |

| [44] | Shahbaz M., Samia N. and Faisal A. «Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries?», Energy Economics, 51, 275-287, 2015. |

| [45] | Sotamenou J. et Nguepdjio C. N. «Energy consumption, economic growth and CO2 emissions in Cameroon: a causal analysis», African Intergration and Development Review, 11, 82-100, 2019. |

| [46] | Syed Q. R., Bhowmik R., Adedoyin F. F., Alola A. A. and Khalid N. «Do economic Policy Uncertainty and Geopolitical Risk Surge CO2 Emissions ? New Insights from Panel Quantile Regression Approach», Environmental Science and Pollution Research International, 29, 27845-27861, 2022. |

| [47] | Tang C. F. and Tan B. W. «The impact of energy consumption, income and foreign direct investment on carbon dioxide emissions in Vietnam», Energy, 79, 447-454, 2015. |

| [48] | Terzi H. and Pata K. «Is the pollution haven hypothesis (PHH) valid for Turkey?», Panoeconomicus, 67, 93-109, 2020. 67(1): 93-109. |

| [49] | To H. A., Dao Ha T-T., Nguyen H. M. and Vo Hong D. «The Impact of Foreign Direct Investment on Environment Degradation: Evidence from Emerging Markets in Asia», International Journal of Environmental Research and Public Health, 16, 1636, 2019. |

| [50] | World Bank «World development indicators». World Bank, Washington DC, 2023. |

| [51] | Zafar M. W., Qin Q., Malik M. N. and Zaidi S. A. H. «Foreign direct investment and education as determinants of environmental quality: The importance of post Paris Agreement (COP21)», Journal of Environmental Management, 270, 110827, 2020. |

APA Style

Oumarou, M., Nourou, M., Ibrahim, Philemon, V. (2024). Foreign Direct Investment and CO2 Emissions in Sub-Saharan Africa: A Heterogeneous Panel Causality Analysis. International Journal of Economy, Energy and Environment, 9(5), 105-118. https://doi.org/10.11648/j.ijeee.20240905.11

ACS Style

Oumarou, M.; Nourou, M.; Ibrahim; Philemon, V. Foreign Direct Investment and CO2 Emissions in Sub-Saharan Africa: A Heterogeneous Panel Causality Analysis. Int. J. Econ. Energy Environ. 2024, 9(5), 105-118. doi: 10.11648/j.ijeee.20240905.11

AMA Style

Oumarou M, Nourou M, Ibrahim, Philemon V. Foreign Direct Investment and CO2 Emissions in Sub-Saharan Africa: A Heterogeneous Panel Causality Analysis. Int J Econ Energy Environ. 2024;9(5):105-118. doi: 10.11648/j.ijeee.20240905.11

@article{10.11648/j.ijeee.20240905.11,

author = {Mohamadou Oumarou and Mohammadou Nourou and Ibrahim and Votsoma Philemon},

title = {Foreign Direct Investment and CO2 Emissions in Sub-Saharan Africa: A Heterogeneous Panel Causality Analysis

},

journal = {International Journal of Economy, Energy and Environment},

volume = {9},

number = {5},

pages = {105-118},

doi = {10.11648/j.ijeee.20240905.11},

url = {https://doi.org/10.11648/j.ijeee.20240905.11},

eprint = {https://article.sciencepublishinggroup.com/pdf/10.11648.j.ijeee.20240905.11},

abstract = {Following the density of the literature and the consensus in empirical studies, the aim of this article is to examine the nature of the relationship between foreign direct investment (FDI) and carbon dioxide (CO2) emissions in sub-Saharan Africa (SSA). To this end, the methodological strategy employed is based not only on a theoretically sound multivariate framework, but also on recent developments in panel data econometrics, namely fully modified ordinary least squares (FMOLS) estimators, dynamic ordinary least squares (DOLS) estimators and the vector error correction model. In addition, the stationarity properties of the panel variables are examined, and the panel cointegration technique is used to test cointegrating relationships in the series of variables. The panel is composed of 38 SSA countries over the period 2000-2022. The main results show that in SSA: the variables move together in the long term. A 1% increase in inward FDI increases CO2 emissions by 0.210%. This result suggests that FDI has flowed to SSA because of its weak environmental regulations, thus verifying the pollution haven hypothesis. In the long term, there is a bidirectional relationship between inward FDI and CO2 emissions. In all the models used, renewable energy consumption reduces CO2 emissions. Therefore, SSA needs to put in place effective environmental rules to better guide FDI; put in place strategies to harness and add value to its energy sector, implement policies and strategies that ensure FDI attractiveness without abandoning the environment.

},

year = {2024}

}

TY - JOUR T1 - Foreign Direct Investment and CO2 Emissions in Sub-Saharan Africa: A Heterogeneous Panel Causality Analysis AU - Mohamadou Oumarou AU - Mohammadou Nourou AU - Ibrahim AU - Votsoma Philemon Y1 - 2024/09/23 PY - 2024 N1 - https://doi.org/10.11648/j.ijeee.20240905.11 DO - 10.11648/j.ijeee.20240905.11 T2 - International Journal of Economy, Energy and Environment JF - International Journal of Economy, Energy and Environment JO - International Journal of Economy, Energy and Environment SP - 105 EP - 118 PB - Science Publishing Group SN - 2575-5021 UR - https://doi.org/10.11648/j.ijeee.20240905.11 AB - Following the density of the literature and the consensus in empirical studies, the aim of this article is to examine the nature of the relationship between foreign direct investment (FDI) and carbon dioxide (CO2) emissions in sub-Saharan Africa (SSA). To this end, the methodological strategy employed is based not only on a theoretically sound multivariate framework, but also on recent developments in panel data econometrics, namely fully modified ordinary least squares (FMOLS) estimators, dynamic ordinary least squares (DOLS) estimators and the vector error correction model. In addition, the stationarity properties of the panel variables are examined, and the panel cointegration technique is used to test cointegrating relationships in the series of variables. The panel is composed of 38 SSA countries over the period 2000-2022. The main results show that in SSA: the variables move together in the long term. A 1% increase in inward FDI increases CO2 emissions by 0.210%. This result suggests that FDI has flowed to SSA because of its weak environmental regulations, thus verifying the pollution haven hypothesis. In the long term, there is a bidirectional relationship between inward FDI and CO2 emissions. In all the models used, renewable energy consumption reduces CO2 emissions. Therefore, SSA needs to put in place effective environmental rules to better guide FDI; put in place strategies to harness and add value to its energy sector, implement policies and strategies that ensure FDI attractiveness without abandoning the environment. VL - 9 IS - 5 ER -